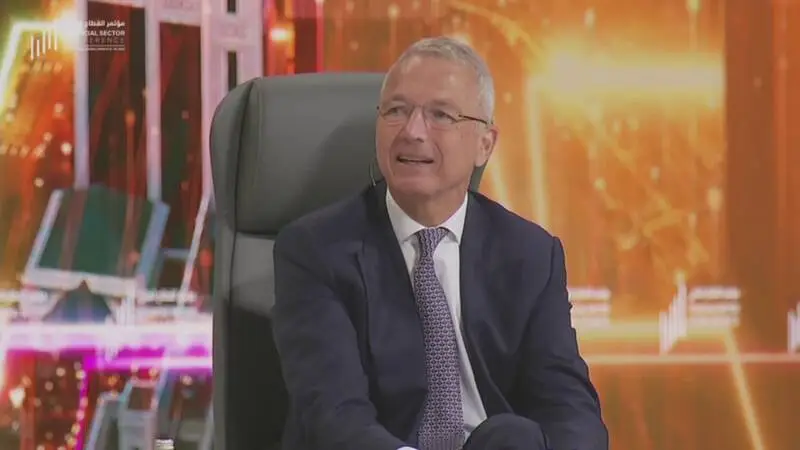

Credit Suisse chairman says Silicon Valley Bank crisis looks 'local and contained'

The contagion effect from the recent collapse of Silicon Valley Bank is local and contained, said Credit Suisse Chairman Axel Lehmann on Wednesday.

Embattled lenders Silicon Valley Bank and Silvergate were not subjected to strict enforcements that govern bigger banks in the U.S. and other parts of the world, Lehmann told CNBC's Hadley Gamble at a panel session in Riyadh.

related investing news

"I look to what has happened in Silicon Valley Bank, and subsequently other midsize banks — they are not really subject to stringent regulation, as you have in other parts of the world," he said, citing the Basel III requirement that underpins most banks' operating framework.

"So in this regard, I think [the contagion] is somewhat local and contained," he said.

However, Silicon Valley Bank's fallout still serves as a "warning signal" for the overall market climate, the chairman cautioned.

European markets closed sharply lower Monday amid the fallout from the SVB crisis. On Friday, SVB was taken over by regulators after massive withdrawals a day earlier effectively created a bank run. HSBC then on Monday agreed to buy the British arm of the troubled U.S. tech startup-focused lender for £1. Concerns of contagion and increased regulation and just some general profit-taking caused European banks to post their worst day in more than a year on Monday.

Credit Suisse, itself, has seen some major volatility during this period, falling another 9% on Wednesday morning. The Swiss lender on Tuesday revealed that it had identified "certain material weaknesses" in its internal control over financial reporting for the years 2021 and 2022. It also recently confirmed its 2022 results announced Feb. 9, which recorded a full-year net loss of 7.3 billion Swiss francs ($8 billion).

When asked if he would rule out some kind of government assistance in the future, Lehmann answered: "That's not the topic." "We are regulated, we have strong capital ratios, very strong balance sheet. We are all hands on deck. So that's not the topic whatsoever."

An emphasis on de-risking Credit Suisse's balance sheet is also underway, he added.

2023 and 2024 are the years for the bank to stabilize, Lehmann said, with a focus on global wealth management business in Asia, in the Middle East and in Latin America.