Inflation ticks upward to 3.7% for August 2023: Here's how it could affect interest rates

Prices for U.S. consumers grew 3.7% in August compared to a year ago as gasoline prices spiked, according to the Bureau of Labor Statistics.

Inflation was about equal to expert projections, and prices rose at a faster pace than the previous month. On a month-over-month basis, the inflation rate rose by 0.6%, compared to 0.2% in July.

Economists had expected the data to show a 3.6% overall increase in inflation compared to a year ago. Annual inflation has now ticked up two months in a row after 12 consecutive months of decline.

Core inflation, a measurement of cost increases that removes energy and food prices because of their volatility, rose 4.3%. That, too, matched estimates from experts.

The Federal Reserve has been focusing on core inflation recently as it tries to crimp inflation.

Broadly speaking, the central bank's effort seems to be working. Overall inflation as measured by the government's Consumer Price Index, or CPI, was 3.2% in July compared to July 2022. Core inflation was 4.7% that month.

"If you look at what’s going on underneath the surface, core inflation continues to gradually cool," said David Kelly, chief global strategist for J.P. Morgan Asset Management. "I don’t think people should look at it as some kind of revival of inflation pressure."

Gasoline prices rose 10.6% compared to July and fuel oil prices jumped 9.1%, according to the federal government. That drove up transportation costs. Both commodities cost less than they did a year ago, however.

Sarah House, senior economist for Wells Fargo, told NBC that gas prices usually fall in August as consumers start to drive less, but this year was a break from that pattern because of cuts in OPEC oil production. That made for a notable increase in gas prices.

Home prices and rents have also been major contributors to persistent inflation, and in August, the BLS' shelter index climbed 7.3% from a year ago.

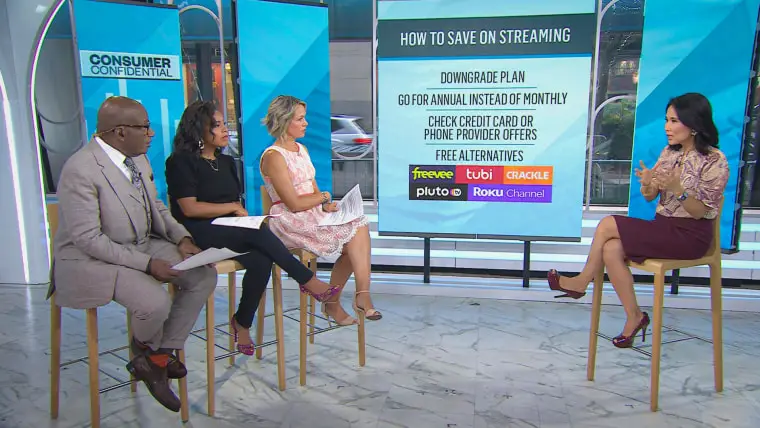

How to save on (and cancel) digital and streaming services

Sept. 13, 202305:22Moving cautiously in the right direction

Beth Ann Bovino, chief economist for US Bank, said it’s significant that wage gains have been greater than inflation in recent months. That restores a bit of the pricing power that consumers lost as inflation spiked.

"Overall the big picture is that inflation is much lower overall than last year. The Fed rate hike action has had impact. That said, they’re not across the finish line," Bovino said.

Inflation has slowed significantly since last summer, when surging prices for fuels, housing and used automobiles sent the measurement to 40-year highs. Fuel and used car prices have come down.

Overall the big picture is that inflation is much lower overall than we were last year. The Fed rate hike action has had impact. That said, they’re not across the finish line."

Still, inflation remains higher than it was throughout the 2010s. It's also well above the Federal Reserve's stated 2% target.

The persistent inflation contributed to the dramatic increases in interest rates over the last year and a half. The Fed raised rates from just above zero in early 2022 to their current range of 5.25% to 5.50%. That's the highest since 2001.

Because financial institutions use the benchmark U.S. interest rate to set their own interest rates, mortgage and credit card interest rates are also the highest they've been in decades. Interest rates have been historically low dating to the 2007-08 financial crisis, making it harder for people and businesses to borrow.

If inflation continues to cool down, the Fed is more likely to stop raising interest rates for the time being. That's something investors and business leaders have wanted to see, because they're worried the steep increases in rates will cause a recession.

The Fed’s moves were intended to stem inflation by slowing the economy. Still, the job market has stayed tight and wages have continued to increase, and there have been few signs that a recession is on the way.

"The economy does seem to be resilient in the face of higher interest rates," Kelly said. "Working families are gradually doing a little bit better this year."

He said that consumers are feeling a "squeeze" from the surge in gas prices, even if it's temporary, as well as the end of the three-year pause in federal student loan repayments. But Kelly said economic conditions are pretty good right now: Inflation is coming down, and the job market is tight, which keeps wages steady.

"That’s about as good as we can expect," he said. "The best we can hope for is a soft landing, and there’s nothing in this report that tells me we can’t achieve it."

But the public still feels negative about the economy, and President Joe Biden's approval ratings on the topic remain low. That's partly because inflation was so bad a year ago and remains persistent today. It could be one of his biggest challenges heading into his re-election campaign.

And if inflation isn't clearly on the decline, more rate hikes could follow before long. That would send the cost of borrowing money even higher and weaken the economy further.