The U.S. economy in 2023: Most people have jobs, but many are unhappy about their money

If you don't quite know how to feel about the U.S. economy at the moment, you're not alone.

The highest inflation rates in four decades have caused U.S. consumers to turn sour on how they view their personal finances. Gallup found in a survey published last month that 50% of the respondents said their financial situations were worse than they were a year ago — the highest percentage since 2009.

And despite some data showing lower-wage workers' pay is improving, 61% of lower-income people — those who earn no more than $40,000 a year — told Gallup their financial situations had deteriorated over the past year. That's a higher percentage than for any other income group — yet even among higher-earning people, those who make at least $100,000 a year, 43% said they now feel pinched. NBC News has reported about how some people earning six figures or more were having to find ways to aggressively shore up their finances.

And yet, alongside the negative sentiments, economists cite a slew of data showing the U.S. consumer remains financially healthy.

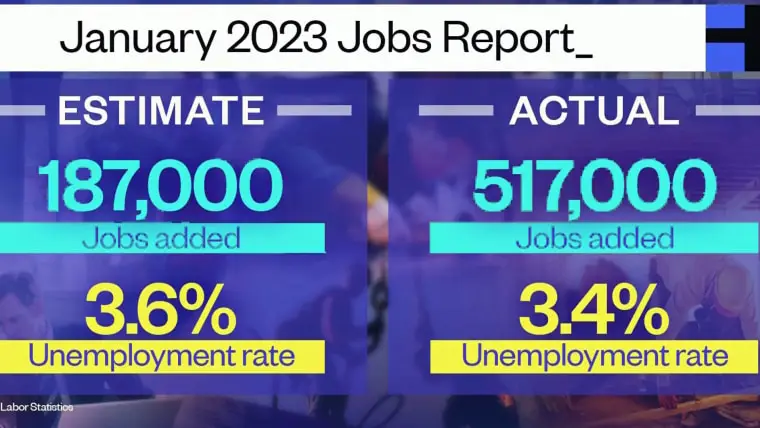

Start with the unemployment rate, which, at 3.4%, is below pre-pandemic levels.

Meanwhile, as inflation has begun to decelerate, the aggregate amount of disposable income in the economy is starting to climb again, having recorded seven consecutive months of growth since June. Aggregate savings in the economy show a similar trend.

That has translated into sustained demand, which in turn produced a January jobs report that showed 517,000 jobs added — the most since July. And while gross domestic product has also most likely peaked in the post-pandemic period, it remains firmly in positive territory, with 2.9% growth in the most recent quarter.

"By most objective measures, consumers are still doing fine," said Preston Caldwell, a senior U.S. economist at Morningstar, a financial services company. "And they're spending as if they're in good shape. So I wouldn’t pay much attention to what [the Gallup Poll] tells you."

Federal Reserve Chairman Jay Powell said Tuesday that growth in the economy is, in fact, still too robust.

“The latest economic data have come in stronger than expected, which suggests that the ultimate level of interest rates is likely to be higher than previously anticipated,” Powell said in remarks prepared for his two appearances this week on Capitol Hill.

“We have covered a lot of ground, and the full effects of our tightening so far are yet to be felt,” Powell said of the Fed's program of raising interest rates to slow investment and borrowing. “Even so, we have more work to do.

"There is little sign of disinflation," he added, referring to a substantial reversal of higher prices.

Many economists now believe interest rates are going to climb so much that — as the key federal funds rate large banks use for overnight borrowing from the Federal Reserve approaches 6% — a recession is likely by the end of the year.

"We still haven’t seen the full effects of the Fed's tightening," said Sarah House, a senior economist at Wells Fargo. "As financing becomes more expensive, there's going to be weaker demand for big-ticket consumer items. And as we see overall spending weaken, profits are going to be squeezed.

"Companies will then start looking at their investments and hiring practices, and that’s where a recession is likely to come from, that tighter [monetary] policy environment," House said.

On Friday, the Bureau of Labor Statistics will release its jobs report for February. Economists expect new jobs added to come in at 225,000 — about half of January's reading. And next Tuesday, the bureau will release the latest inflation data for the U.S. economy. If either figure comes in stronger than expected, it will confirm that the economy is still running hot, and it is likely to make the central bank's efforts to tackle inflation even harder.

U.S. January jobs report crushes expectations

Feb. 3, 202303:39And that would mean more — and higher — interest rates would be in the offing, raising the cost of housing to car loans to credit cards.